When it comes to vulnerable customers, we believe that

is the only way to start the conversation.

How TellJO works

A customer is sent a link to a TellJO wellbeing check, based on your objectives this could be after a missed payment or period of non-engagement. The message asks:

When they respond, we chat. As a trusted B Corp and third party, your hard-to-reach customers are 5x more likely to self-disclose with TellJO, compared to a phone call or email from you. In an average time of 7 minutes, TellJO asks around 90 questions.

We use 63 indicators of vulnerability and can automatically refer those identified to your contact or customer care teams. Together we can create tailored pathways based on vulnerability to improve your customers’ wellbeing.

After the questions you can choose key signposts and calls to action for customers including:

Payment Arrangement Request – over 89% of users ask to pay their arrears. We can return £20 for every £1 spent on TellJO in new affordable payment arrangements.

Water Utility –PSR and social tariffs – over half of customers request to go onto the priority services register and/or social tariffs.

Debt Advice – within 60 seconds of receiving the signpost 43% of people called debt advice.

Based on their answers we provide the customer with direct links to relevant support services. Customers tell us that they feel on average 86% better about their situation after completing a wellbeing check, are 98% are likely to use the signposts given.

In our experience:

May be experiencing suicidal thoughts.

May be experiencing addiction.

Will talk about domestic abuse.

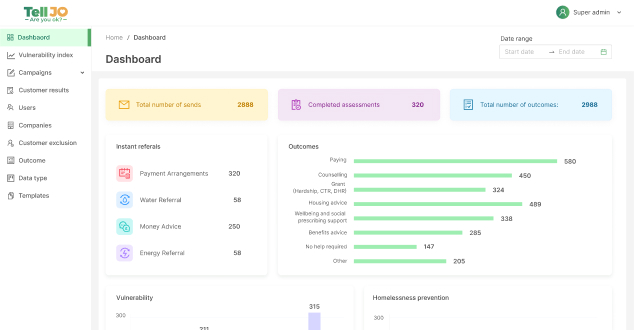

Over 90% of customers give permission for you to access their data on our report dashboard. It can also be delivered to you for upload to your CRM or through an API.

Organisations love TellJO.

And so do their customers.

Awards and recognition

Proud to be listed by the Credit & Collections Technology Awards for our work in Vulnerable Customer Identification

Proud to be recognized by the Credit & Collections Technology Awards for Digital Transformation

Proud to be commended at the IRRV Performance Awards for our focus on Social Inclusion

Proud recipients of a Sustainability Grant from Innovate UK