By Dr. Thomas Richardson, Clinical Psychologist and TellJO Senior Advisor. Originally published June 2022.

The cost-of-living crisis is really biting in the UK and a mental health crisis is growing.

How TellJO can help break the link.

Inflation is currently at 10.4% with inflation for food items the highest for 45 years, with vegetables increasing by 18% in a year. As a result, the number of people struggling financially is also increasing: 40% of the UK population, 21.1 million people, are currently in need of financial or debt advice.

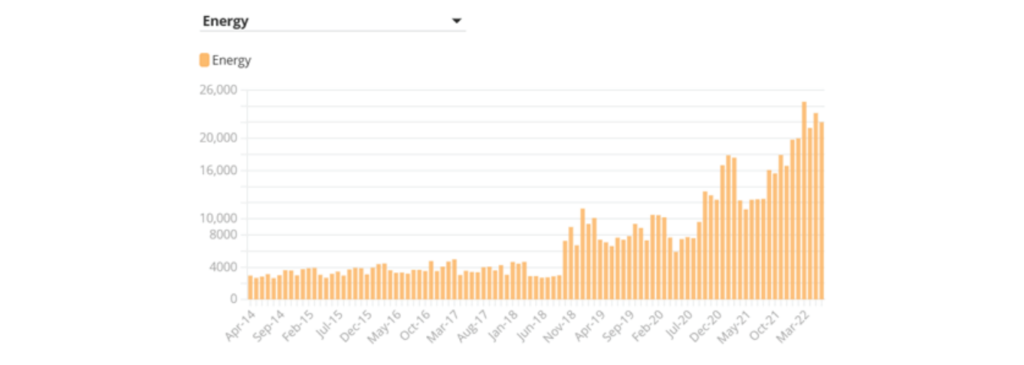

Energy prices have increased 66.7% in the past year and electricity 129%. The graph below from Citizens Advice shows the increase in number of people seeking help for energy costs.

As a clinician who has spent years working with those with mental health problems and researching the link between financial difficulties and mental health, I can tell you that the cost-of-living crisis has the potential to also be a significant mental health crisis.

Even before the current energy cost increases, those with mental health problems were at least three times as likely to have energy debts. Government statistics show that those with depression symptoms were more likely to struggle to keep warm this winter.

A few years ago I published a meta-analysis, which is where you statically pool together all the previous research in an area.This showed that those in debt are more than three times as likely to have a mental health problem. With a huge 41.9% of those in debt also having a mental health problem.

More than half of UK adults have reported feeling depressed, anxious or unable to cope in the current economic climate.

It is often a vicious cycle. You become depressed at the state of your finances, and then when you are depressed it is hard to concentrate on paying the bills. You might lose income, so your money problems worsen.

Watch Dr Thomas Richardson explain the links between debt and mental health

There is help out there for both cost-of-living and mental health, but it can be hard to access.

If you are depressed or anxious, everything can feel overwhelming and terrifying. Even the idea of ringing up the council to talk about council tax arrears, or ringing to make an appointment with your GP, can feel too much.

Avoidance is a key part of many mental health problems, and finances is no different. We’ve all had the experience of avoiding checking your bank balance at the end of the month. Imagine that times twenty.

A real bugbear of mine is that services are largely set up as a separate. You go here for your mental health, you go here for your finances. Never the twain shall meet.

This separation makes it very hard for people to access support. If you are very depressed, being told by a health professional to take a flyer about debt advice might not do a lot. In fact, trials testing just this have been abandoned due to hardly anyone contacting for debt advice in this way. People fall through the gaps between services.

But mental health and poverty are so interlinked and overlapping as to essentially be the same problem. To help people with both, we need interventions which tackle them at the same time.

To help those with mental health problems, we need support to be convenient, easily accessible, non-threatening and quick: The longer people have to wait the worse things will get and the more likely it is that they will disengage.

This is where TellJO can help

Rather than having to navigate through tonnes of information and make lots of challenging phone calls and have difficult discussions where you might not be totally open about just how much you are struggling, you can do it all in a few minutes. Online, whenever and where you want.

We will ask the right questions to determine vulnerability. Much easier, for someone who is highly stressed, depressed or anxious, then having to volunteer this information themselves. Many people who are depressed or anxious might not even know it, let alone be accessing help, but we screen for this.

It’s a gentle nudge to help, more convenient and less threatening than an angry red letter through the door. (That someone who is depressed may well just throw away rather than open!).

This seems to be working better than the traditional debt collection approach for our vulnerable customers:

- Three-quarters of customers, who are in debt such as Council Tax or Rent Arrears, request to make a payment.

- It’s kinder and more supportive for the customer, easier and more effective for the organisation.

- You are automatically signposted to support: mental health, debt advice, benefits support.

All in one place, a one stop shop. No need to spend time researching what to do next and trying to make sense of conflicting information and advice. We will do it for you. Take the pressure off and prevent things getting worse. Stop the vicious cycle. A bit more hope and feeling a bit more in control of your finances can go a long way to helping your mental health.

Our case studies really highlight this, see how TellJO helped Emma in this short video.